Cut State Income Tax Rate

by Alex Saitta

April 15, 2019

In 2018 the state had a $200 million surplus. In 2019 the surplus is $350 million. Likely that will be spent, like it most always is.

The Republican led legislature raised the gas tax 12 cents. It also doubled the pension tax as well. It is about time the Republicans start acting like conservatives. To that end, they should cut income taxes and return some of the surplus money to the taxpayers.

Our state income tax rate of 7% is one of the highest in the country. Georgia's is 6% and North Carolina's is 5.5% by the way. The best thing to do is cut the highest tax rate from 7% to 6%. However, I don't think our moderate legislature will think that big.

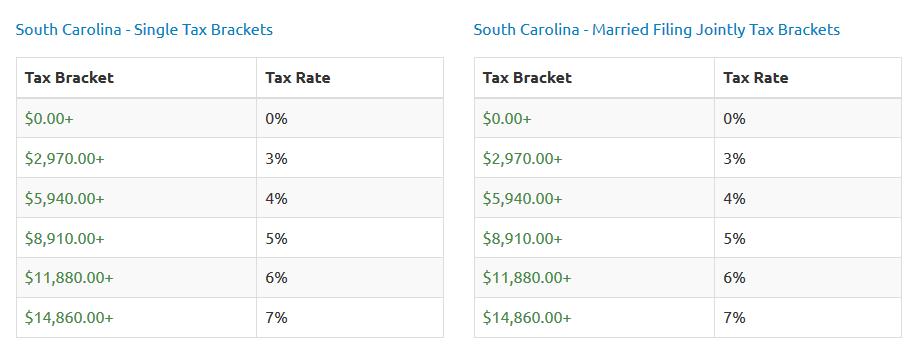

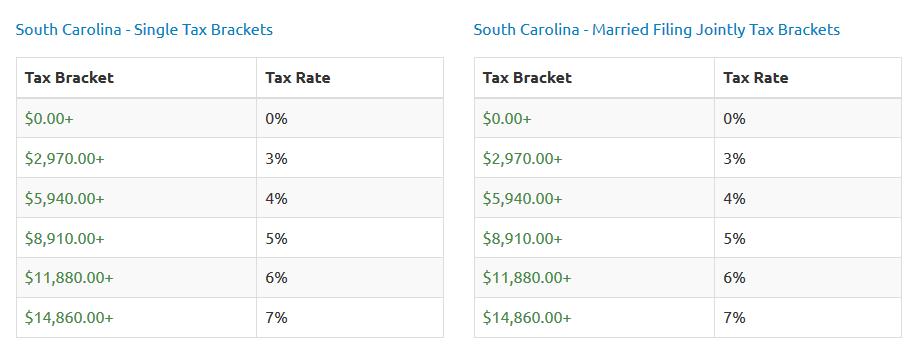

More ideas... look at where the top rate kicks in, at such a low taxable income level ($14,500). (See the income tax rate schedule for both single and married.)

There are two possibilities here when it comes to a modest tax cut.

One, keep the highest rate 7%, but raise the income threshold that rate kicks in from $14,500 to like $50,000. That would provide middle class tax cut relief because that would drop the marginal tax rate for most from 7% to 6%.

Two, the legislature could eliminate the marriage penalty in the SC income tax rate schedule. Now the married tax brackets are a mirror image of the single bracket. That is a penalty for a married couple where both spouses work.

First, let me explain how income taxes work. Looking at the single and married joint tax schedule, you pay 3% tax on your income from $0 to $2,970, 4% on income from $2,971 to 5,940, 5% on income from $5,941 to $8,910, 6% on $8,911 to $14,860 and 7% on all your income above $14,860.

To eliminate the marriage penalty, you double the thresholds for each tax rate. Doing this married couples would pay 3% on income from 0 to $5,940, 4% on income from $5,941 to $11,880, 5% on income from $11,881 to $17,820, 6% from $17,821 to $23,760 and 7% on any income over $29,720.

Home Write-ups Videos About Us Contact Us