True Inflation

By Alex Saitta

July 19, 2021

For the longest time I've been saying inflation measured by the Consumer Price Index (CPI) is bogus. Finally, people are beginning to see what I mean. Mainly, there are adjustments to quality changes and the basket of goods and services is constantly changed, and both work to understate inflation in today's CPI.

For example, 15 years ago if a 30 inch TV cost $400 and today a 60 inch TV (twice the size) costs $400, the CPI adjusts for quality and the cost of that TV today in the index drops to $200. So TV's are dragging down the inflation index. However, the reality is the cost of TV's on the shelf today are the same as they were 10 years ago. Not half the price.

Import and export prices have no such adjustments. The past 12 months import prices are up 11.6% (see item 1). Export prices up 16.8% (see item 2).

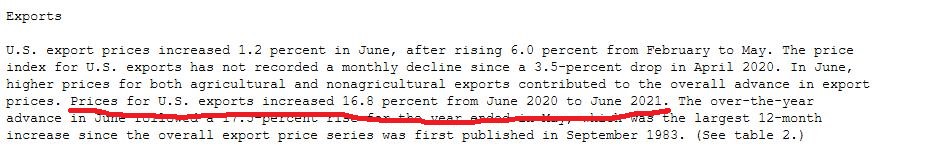

CPI calculated using the 1990 formula is running about 9% (see item 3 - blue line).

Those two measures are a more accurate reflection of true inflation than today's CPI which is running now about 5%.

Economic activity is high due to the Covid rebound and all the fiscal and monetary stimulus, but the economy overall is not healthy because purchasing power is being chewed up by inflation. When wages are growing at 3.5% and true inflation is 9%, that average worker's purchasing power falls by 5.5%.

This "negative" math has been going on for 10 years now. This is why dollar stores and dollar menus are thriving, why government handouts are increasing and why consumer debt is at record highs.