Precious Metals

by Alex Saitta

March 15, 2022

Inflation Tax:

For the past ten years I have been saying the official inflation rate is understated, the true inflation rate is higher and also greater the growth in average wages. As a result, the purchasing power of the typical person is slowly declining, if he/ she is not invested in stocks, real estate or commodities. Looking back, I think I was right and the decline in purchasing power has impacted those living pay check to pay check the most. (About 50 to 60% of Americans have no or next to no savings. This inflation tax is one of the reasons more and more are falling into the government safety net.

Ten years ago I took two steps to hedge myself against this. One, was to buy local real estate. Two, was to buy precious metals. The former has done well. The latter not so good. The past 5 years Gold has remained about the same, 1,845 to $1,950. Silver has risen from $18.25 to $25.25. In contrast the Dow Jones Industrial Average has rallied from 17,880 to 32,100. I missed most of that. I thought with true inflation running about 10%, gold would be at $3,000 by now. Stocks and crypto currency have been a better hedge, though I don't think that will last. (I think Bitcoin is heading to 10,000, for instance.)

Metals Still Appealing:

Given I see the glass as half empty and things continue to decay not only economically, but morally, socially and spiritually, metals still appeal to me. A person can buy precious metals a variety of reasons, depending:

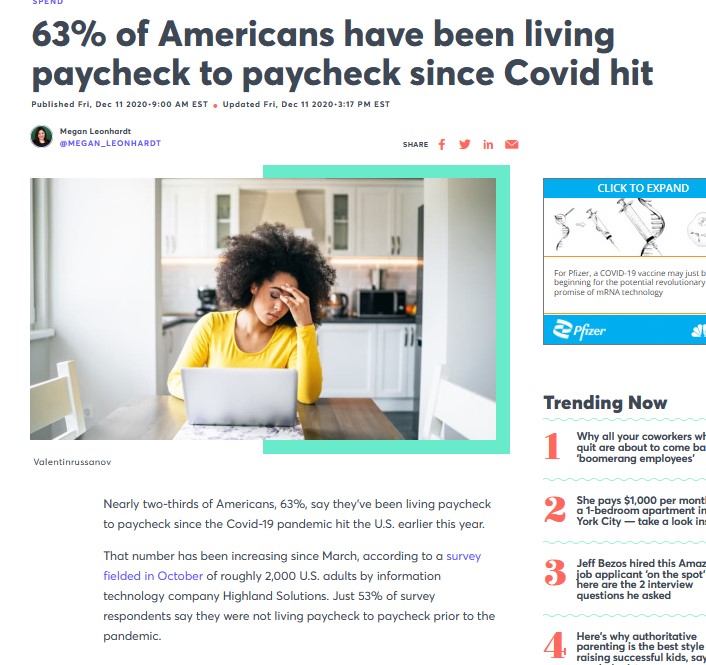

Barter:

If the US dollar and the currencies of the world ever collapse and we are forced into a barter system, you’ll be happy you have some silver coins. US 1964 and earlier dimes, quarters, half dollars and dollar coins are made of 90% silver. Buy what is called “junk” or circulated silver dimes and quarters. When it costs $40 yesterday, $50 today and $60 tomorrow to buy that loaf of bread, you’ll be happy you’ve got a 1958 dime in your pocket. No need for change either. There is a premium on bags of junk silver today, but I would not be without a bag silver dimes and quarters.

Storage of Wealth:

If you are tired of earning 0.5% on your $100,000 CD, 1 oz bars of gold or platinum or a 100 oz bar of silver may be a good buy and hold till death alternative. You won’t use those for bartering, because you can’t make change. They are just a place to store some of your wealth if you feel stocks, bonds or real estate could head south at some point. Make sure you keep them in a safety deposit box.

Investment:

Let’s say you like the price of gold or platinum over the next few years, and want to invest long-term. Open an account and buy an ETF or mutual fund (a fund of gold, silver, mining stocks or the actual metals themselves). You can also buy and hold the stock of a precious metals mining company like Newmont Corporation (NEM).

Speculation:

You feel the price of gold, silver or platinum is going to rise in the short-term, and you want to speculate on the price. There leverage matters. You could buy a futures contract on gold, silver or platinum or an option on those. You could lose your shirt doing this, so do not try this at home.