2021 Council Redistricting

By Alex Saitta

March 22, 2021

Introduction:

Every decade there is a population census in the US. In its wake, federal, state and local lines for elected offices are redrawn to equal out populations. In Pickens County, for instance, “redistricting” must insure the populations of the 6 council districts are within 10%. Most see that as the average plus or minus 5 percent.

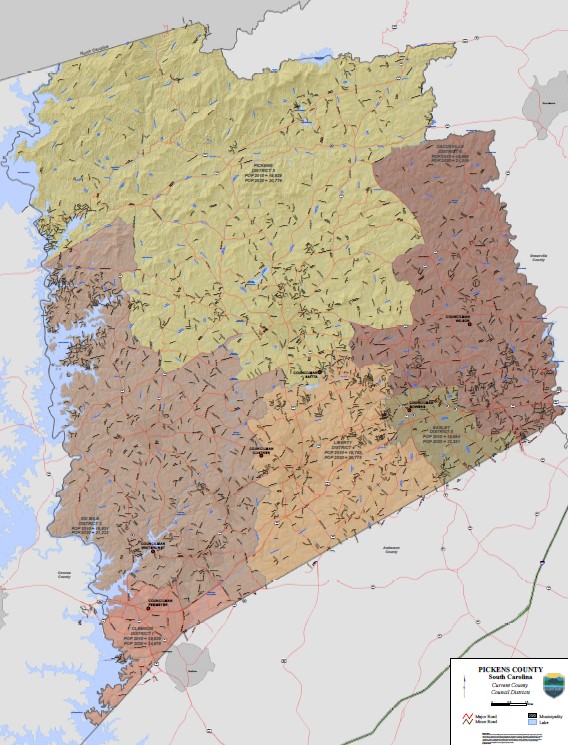

Old Council Map:

Picture 1 is the old county council map based on the 2010 census. Pickens County 2020 census population is 131,404, divided by the 6 county council districts, equals an average of 21,900 per district. Thus, the population of each district must be within the range of 20,805 to 22,995. With the old lines from 2010, the Easley, Dacusville and Six Mile/ Central districts are within that 10 percent range. The Pickens district was 26 people below the range. The Liberty district was 14 people below the range. Clemson was 1,893 above the range because the growing number of students at Clemson University.

Criteria:

Each elected body creates their own lines. For instance, the SC State House creates the house district lines. Likewise, the county council creates its district lines. For starters, we did not want split precincts — like half the AR Lewis precinct voting for councilmen Jones and half of AR Lewis voting for councilmen Smith. This would have meant the voting machines in that polling place would have had two different ballots. Confusing.

Only the state legislature can move precinct lines. As a result, the council limited itself to swapping precincts in order to put the 6 districts back in the 10 percent range.

Seventh School Board Seat:

By the way, this is one reason I opposed the school board changing from 6 districts that mirrored the council districts, to 7 districts that now make things complicated for those who have to program the voting machines, and confusing for voters. For instance, many who elect the Six Mile rep on the county council, vote for the Pickens trustee on the school board. Many who live in front of Pickens High School, vote for the Dacsville trustee on the school board for instance. Politics.

And adding the seventh seat to the school board changed little to nothing in how the board votes. The year before the seventh seat was added, 98 percent of the school board votes were 6 to 0 and had no opposing votes. The year following the addition of the seventh seat, 95 percent where unanimous. It was before, and still remains a rubber stamp school board, but I digress…

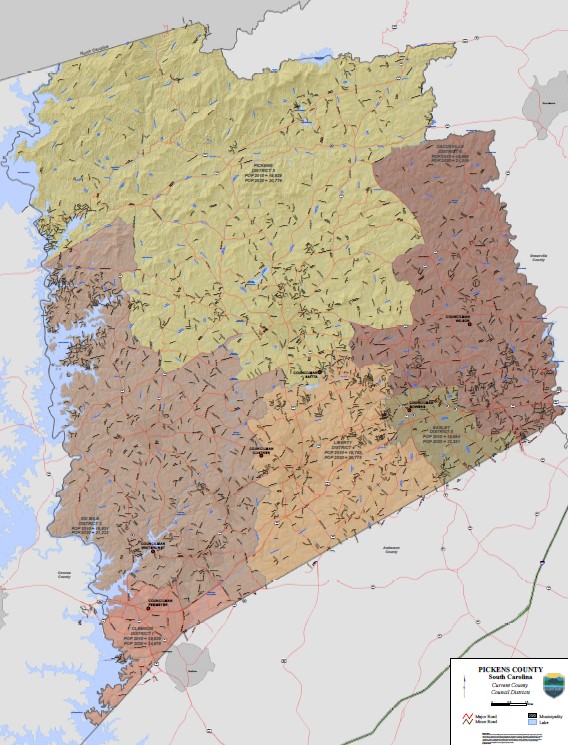

New Council Map:

Continuing on, the county administration created two county council redistricting options. Option 1 was quagmire of changes all over the county. Option 2 focused on the western side of the county where the imbalances were and swapped only 4 precincts to put all the districts in the 10% range.

The council approved option 2 in a unanimous vote (see picture 2). Starting with the upcoming primary, the Calhoun precinct will now vote for the Six Mile/ Central council seat. Those in the Norris and Praters Creek precincts will vote for the Liberty seat. Those in the Skelton precinct will vote for the Pickens seat. Four changes.

The less changes, the less confusing for voters and the lower the chances of political Gerry-mandering or dirty tricks.

Conclusion:

This new non-political map, without the smudges of the finger prints of elected leaders is quite refreshing given what happened at the state level and how those lines were significantly redrawn in our county. See the December 21 Courier article entitled, “Ex State House candidates level accusations after Rep. Neal Collins served on committee.”

There, former state house candidates Alan Quinn and Phil Bowers made credible charges they were purposely redrawn out of their districts so they could not run again for those seats again in the June primary.