MRR Settlement: Why I Vote "No"

by Alex Saitta

June 1, 2022

Introduction:

Reading the Courier articles about the MRR settlement, I had the same feeling as Ron Barnett (the reporter who covered the story). After 6 years of a employing a go-to-trial strategy, why the 180 degree turn by the county to settle out of court?

The county council voted 4 to 2 to negotiate with and then settle out of court with MRR. Trey Whitehurst and I voted “No” wanting to stay the course and go to trial. Let me explain my reasoning, but first some history.

Administrative Law Case:

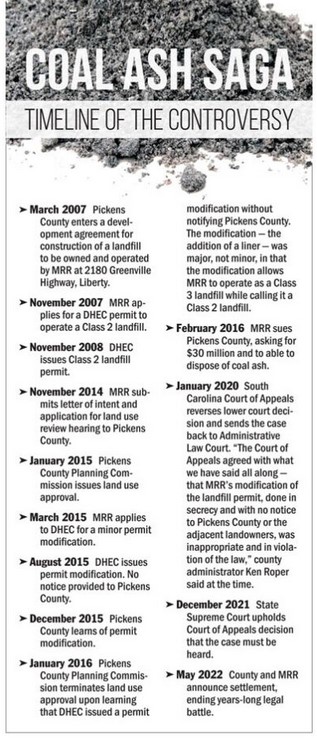

First the administrative law case.

By law a minor modification of a landfill is a routine or administrative change. A major modification substantially alters the facility, its operation or design.

In 2015 MRR set out to add a liner to its landfill to dump coal ash there. If DHEC characterized the change as minor, MRR didn't have to notify the public of the change. If the modification was major, by law MRR had to notify the county, surrounding neighbors and solicit public input.

In August 2015, DHEC classified adding the liner as a minor change, so there was no notice requirement. In December 2015 the county got wind of it, argued the liner was a design change -- hence a major change, and MRR failed to notify the public and the law was violated.

The initial trial and appeal set out to determine if adding a liner and a “leachate collection system for a portion of the landfill” was a minor or major modification?

DHEC Admits It:

Under oath, Kevin Coleman of DHEC (who signed the 2015 minor permit modification), contradicted the minor permit characterization when he said the modification was an "alternative liner design", a "design change", and yeah it was a "new design for the landfill".

DHEC admitted it was a major change; in 2020 the appeals court ruled as such; MRR didn’t properly notify the public and the law was violated.

In 2022 the state Supreme Court said there was an error in the court process, though. The trial court (not the appeals court) should have addressed the minor vs. major question, and the Court ordered the trial court to take up that question. Additionally the Court added to its written ruling a long list of concessions MRR and DHEC voiced, all in support of Pickens County’s argument. Specifically, the Supreme Court wrote: “DHEC’s own representative has admitted the permit modification meets the regulatory definition of a major modification.”

Bam! The case was over then. Those facts just had to be re-tried at the trial court to meet with the Supreme Court’s order. Why did the county then do a 180 turn and settle?

Civil Case:

In a second case, MRR filed a civil complaint against the county for the county’s sudden shut down of the entire landfill when it learned what was going on.

Here I saw potential liability on the part of the county, so I questioned the county's lead attorney on this case. Our attorney responded, no, there were over 130 mis-statements in MRR’s civil case and it didn’t have merit.

My Reasoning:

Three weeks later he did a 180 degree turn, and recommended the county start negotiating to settle. Huh?

Given how strong the minor vs. major case was, the lead attorney’s confidence our defense in the civil case, and for 6 years we all heard was MRR was wrong, the evidence was on the county’s side, and the county was going to prevail in trial, I was skeptical with 180 degree turn to seek an out of court settlement.

Watching the county’s glowing press conference last week, true, it was a victory in the sense the county held MRR to what was initially agreed to: open a Class 2 landfill (with no liner, no hazardous wastes like coal ash), that the county could dump it trash there and pay a fee to do so.

However, to get that original agreement cemented in the here and now, the county paid handsomely in the settlement. The county’s attorney costs were over $750,000 (none reimbursed). The county has to buy 94 acres of lots bordering the landfill for $3.5 million that MRR paid $350,000 for. I don’t see much value in that land, frankly. The county is giving MRR a $3 million interest free loan to finance the costs to build and open the landfill. In sum, the county is laying out about $7 million — a very expensive draw.

Additionally, as Ron Barnett wrote, likely we’ll never know the truth now. Was MRR breaking the law trying to put coal ash in the landfill? Or was DHEC at fault? Was the county liable in how it then shut down the entire landfill? What was being disclosed in the depositions of the civil case that made the county abandon its go-to-trial strategy and move to settle? The case needed to go to trial for the truth to come out on all sides.

Finally, if the county was going to settle, it should have negotiated to buy the landfill. Pickens County desperately needs another landfill as ours is full and we are trucking our trash to Greenville, at the mercy of whatever Greenville charges. When this new landfill opens up, the county will be at the mercy of whatever the owners want to charge, as the rate was not fixed in the settlement agreement.

It kind of reminds me of the Greenville water line running through Pickens County to our lake over there. Years ago leaders in Pickens County said, let Greenville spend the money and build the pipeline. We can just buy the water from them. Now, our leaders see it differently, worried about our own water supply and many are talking of getting our own tap in the lake, building our own plant and our own water line.