School Board Borrowing

by Alex Saitta

February 6, 2025

Some History First:

In 2005 the citizens of Pickens County voted down a $197 million bond referendum to renovate and build new schools. The people sent a clear signal they wanted the schools to be renovated and built a little at a time. Instead of listening to the voters, the next year the school board went around the state constitution and passed the Greenville Plan, borrowing nearly $400 million just by raising their right hands in a 6 to 2 vote.

I was on the school board at the time and voted “No”, and exposed the “Greenville Plan” for the fraud it was. See the Greenville News op-ed below where I explained the scheme in detail.

Massive Tax Hike:

As a result, in 2007 the school bond millage rate sky-rocketed from 19 mills to 58 mills. Bond millage and the tax revenue it raises is used to build, renovate and maintain the buildings. (The operations millage of 110 mills is used to fund the schools day to day to pay for salaries, benefits, textbooks, gasoline for buses, lawn cutting, etc. is not the subject of this write-up.)

With each passing year as more houses were built to help fund that fixed annual bond payment, the more conservative school boards of 2010, 2012, and 2014 passed on those savings to the taxpayer and the tax rate fell from 58 to 52 mills.

When I was defeated in 2016, the administration and the new school board in tow stopped the natural slide in the millage rate, upped the borrowing to raise the tax rate to 54 mills. Since then the administration/ school board has gone on a borrowing spree to keep the rate from falling as it should have in the face of all this growth. Today that bond millage rate should be in the mid 30’s. Instead it sits at 53 mills.

The Math:

The annual bond payment for the Greenville Plan is $22.5 million a year and that goes through 2032. In 2016 (my last year on the board) the school board also borrowed $3.5 million and pulled $1.7 million out of savings to pay for that year’s building improvements of $5.2 million. Hence, total borrowing was $22.5 million for the Greenville Plan and $3.5 for capital needs or a total of $26 million.

The value of a mill was about $500,000 back then. (The value of a mill is how much money the school district raises when it raises the tax rate 1 mill from let’s say 53 to 54 mills.)

Doing the math in 2016: 52 mills x $500,000 = $26 million or what was needed to make that year’s bond payment.

Today’s Math:

Today so many more homes and businesses are paying taxes, so when the millage rate changes by a 1 mill, it raises $750,000. If the school board was still borrowing $26 million a year, divided by the much larger $750,000 value of a mill, the property tax millage rate would be at 35 mills (hence my statement above, “Today, that tax rates should be in the mid 30’s”)

Instead of allowing the growth to push the millage rate lower and the savings to accrue naturally to taxpayers, the savings has been sucked up by the school district in toto, as the district/ board purposely borrows more and more each year to keep the rate locked or “stabilized”.

Today the school board still borrows $22.5 million to pay the SCAGO dummy corporation to pay the Greenville Plan bonds, AND it now borrows over $20 million a year for “capital spending”.

Here are the annual borrowing figures: The Greenville Plan payment has been, is and remains a constant $22.5 million, but the additional capital borrowing was $3.5 million in 2016, $3.8 million in 2017, $5.0 million in 2018, $6.5 million in 2019, $9 million in 2020, $10 million in 2021, $11.0 million in 2022, $12.5 million in 2023, $17.25 million in 2024 and $26.5 million borrowing in 2025.

By the way, the school district voted to refinance its Greenville Plan bond and it saved $6.7 million over the 7 years remaining in the loan. Good idea. However, instead of passing those savings on to the taxpayer in a lower bond tax rate, the district is borrowing and spending every dime of that. Hence the balloon in borrowing next year. The latest is to build four new field houses for each football stadium at $3.2 million each.

Between the Greenville Plan and capital plan, total borrowing for 2025 will be about $48 million. Just to show you how excessive the borrowing has become, the cost of an EMS station with an ambulance and backup ambulance is less than $1 million. With just one annual school board bond payment, the county could build 48 EMS stations with 96 ambulances. The county needs 2 new stations, as it has not built a new EMS station in 13 years.

This is out of control folks. Their policy is to borrow and spend as much as they can and don’t let the tax rate fall.

Need, Not Greed:

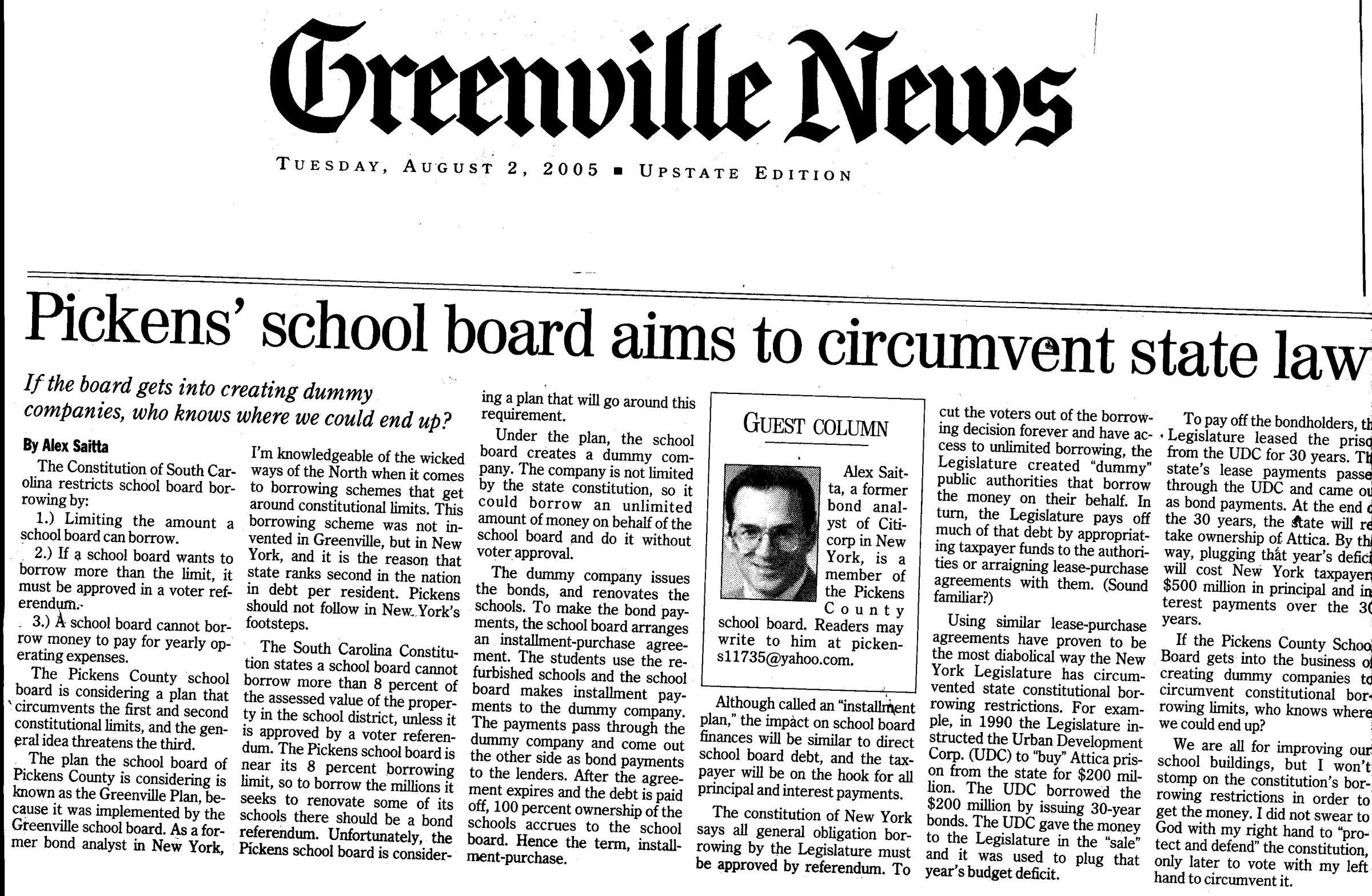

This approach of borrowing as much as the school district can in order to keep the tax rate from falling has caused 5-year capital spending to balloon. When I was defeated in 2016, that 5-year plan was $33.4 million. Today that 5-year plan is $116.8 million (see item above -- right side). That is a 15% growth rate per year.

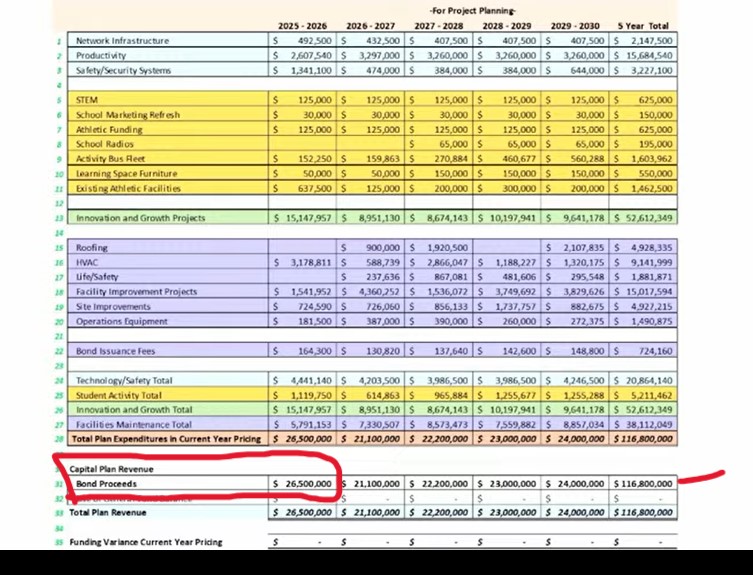

Don’t say it is due to rising student enrollment. During that time 5k-12 school enrollment (45 ADM) has actually fallen from 16,184 to 15,566 (see item 4). School age children are increasing, but the growth is in charter schools, private schools and home schooling. When parents have a choice, they make other choices.

Conclusion:

The total borrowing and interest over the life of the Greenville Plan loan for buildings will be about $750 million. (The initial loan with interest will run about $575 million over the 25 years and the additional borrowing and interest for the capital loans during that time will add about $175 million.) Three-quarters of a billion is excessive. Something needs to change here.

The remaining $150 million in Greenville Plan payments over the next 7 years is fixed. They owe that under contract. The borrowing as much as they can each year on top of that to stabilize the bond tax rate at 53 mills, is the part that needs to change and should change. The school board needs to find out what they need to maintain these buildings in working order and not a dime more. The cost is far too much at this poin

t.