Highway 11 Protections

By Alex Saitta

December 1, 2022

Introduction:

As you know the county has been discussing Highway 11 about 3 years now, and there have been meetings and serious discussions about 20 months. The council majority has formulated a plan. Their plan allows manufacturing, commercial and residential development all along Highway 11.

There is no doubt in my mind, Highway 11 in Pickens County will look very much like it does in Oconee County in time, and the scenic nature of the highway in Pickens County will be all but lost.

Really, I’m calling this the “Highway 11 Land Development Plan”. It is that bad.

The council had four choices: Do nothing, do very little or do not enough and the Scenic Highway as we know it would be lost. Or put in strict land development rules, in a narrow corridor around the highway and protect it as is.

In my opinion, the council majority is going to do “very little”. See the plan below.

History:

Realize, "scenic" is only in the name "Cherokee Foothills Scenic Highway" means next to nothing under the law. It is not a state or federal protected highway, evidence all the kinds of development you see on Highway 11 in Oconee or Spartanburg.

Anyone now could build a dollar store, strip mall, storage warehouse, auto lot, a massive subdivision or clear 1,000 acres of timber and if they can get the logistics right a shopping center or Walmart and the highway being "Scenic" is not going to stop it.

With the all the growth we are seeing around us and little/ no restrictions in place on Highway 11, the question posed was, is the council going to put restrictions in place to protect the scenic highway or just let it be developed willy-nilly like in Oconee, Greenville and Spartanburg?

Study:

In a 5 to 1 vote, in March 2021 the council spent $7,500 and hired ACOG to study Highway 11. I voted “No” because I thought the county government could have done the study in-house and I knew ACOG would not be thorough in the way I felt it needed to be — talking directly to those who live on Highway 11. ACOG held 4 or 5 public meetings, did broad surveys and wrote a report with the history, a lot of facts and it made a few recommendations.

Given Highway 11 sits in my district, I put a lot of time and some money into it. I did 3 or 4 mailers on Highway 11, talked to many via email, and knocked doors on Highway 11. I wrote letter to the editor, was on Facebook, TV and there were articles in the newspaper.

I focused on talking to the residents of Highway 11 who would be regulated. Some houses I knocked twice because they were not home the first time.

My Proposal:

The overwhelming majority of those who live on Highway 11 want to keep the highway as is — scenic. And they are willing to give up some of the land development rights to do that. They want no new manufacturing, no new commercial, no new subdivisions and unrestricted residential single lots, in a narrow corridor around the centerline. Existing establishments were grandfathered in.

I supported that. It is a scenic highway, unique, an exception should be made and protections added.

I said this over and over in council meetings and it never got any traction.

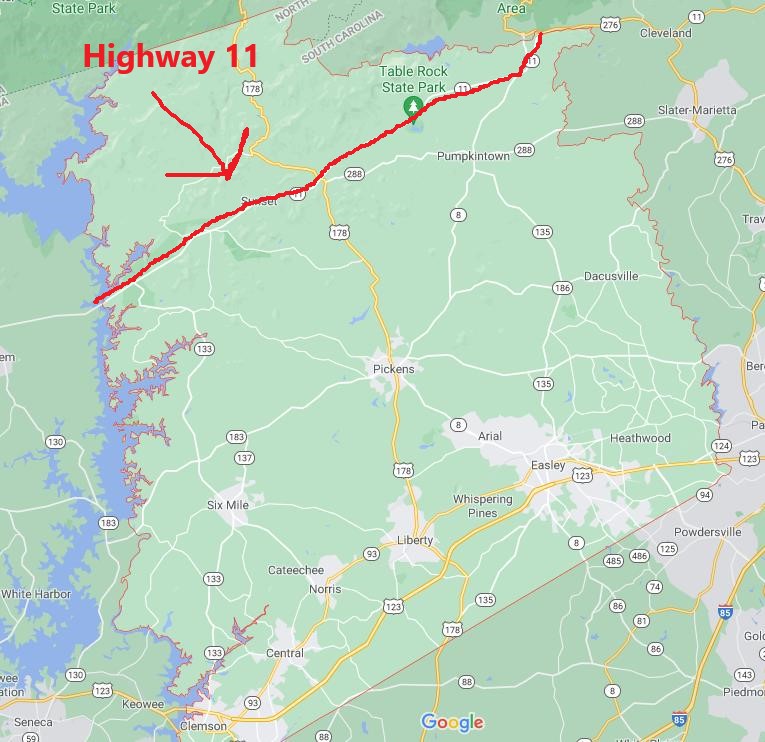

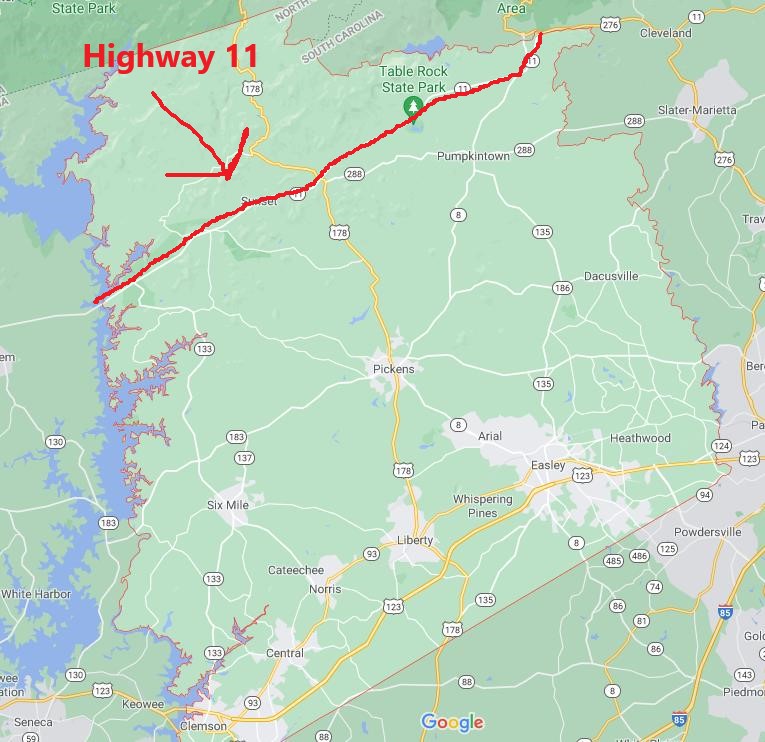

In the end, I proposed a plan that covered +/- 660 feet from the center line that would have made Highway 11 residential only (no new manufacturing, no new commercial). Then re-examine it in 5 years. My proposal covered 5 square miles of the county where there are 512 miles in total. It got 1 vote only.

Their Plan:

What they are calling the Heritage Area extends 1,000 south of Highway 11. North it extends through the view shed. The viewshed is every property that you can see looking north from the centerline. My guess is about 40 square miles total. Inside that the Heritage Area the rules are:

Setback: There is a 150 foot setback on Highway 11. Which is nothing by the way. The closest building at Aunt Sue’s is more than 150 feet off the road. Many of the commercial buildings you see now like the Pumpkintown Mountain Opry are 150 feet off the road. The 150 feet is supposed to be buffered, so the hope is they’ll hide all this stuff below behind some trees.

Light Manufacturing is Allowed: Generally, these are plants less than 200,000 sqf with less than 500 employees on each shift. For example, things like truck terminals, warehouses, wholesale business storage, refinishing shops, monument works, iron workshops, publishing plants, boat works, building material sales, machinery storage, carpet plants, equipment storage yards, dry cleaning/ laundry plants, food processing, packing plants, lumber yards, manufacturing materials, goods, foodstuffs. Not your huge manufacturing plants like BMW or a big Walmart distribution center.

Commercial Development is Allowed: At the intersections of Highways 133, 178, 8 and New Hope Road, Roy F Jones and Carrick Creek, commercial establishments can be right up on the road. Yes, one day they’ll likely be a QT or Cracker Barrel across the street of Grant Meadow and Table Rock Mountain (Carrick Creek Road). Good grief. The rest of Highway 11 can be commercialized with all structures 150 feet back.

Commercial buildings can be as high as 3 ½ stories.

There are design standards, so if someone wants to put a Dollar Store on Highway 11, they can, but it has to look like a tree. Similar for a 200,000 sqf manufacturing plant, but it needs to look like the side of a mountain.

This one-two punch is what I oppose the most, because it allows for the commercialization and industrialization of Scenic Highway 11. Sad.

Subdivisions: 10 homes or less, so small subdivisions will be allowed.

Single Lot residential: Unrestricted.

Conclusion:

This is up for a final vote on Monday. I will be voting “No” as I did on second reading. Highway 11 is a scenic highway. It should not be commercialized or industrialized. An overwhelming majority of those who live on Highway 11, do not want this, and are willing to give up some of their land development rights to protect it.

What is amazing to me is how the process just went off the rails at the end. For the first 18 months of the 20 month process, ACOG, the county and most everyone involved talked about regulating a narrow corridor around Highway 11 of +/- 500 feet, 1,000 feet or 660 feet. A very limited area of 5 to 7 square miles. Most everyone knew about it as this was discussed at the ACOG meetings and maps with the area were widely publicized. A majority of the people on Highway 11 supported such an action.

In September, and with no public notice, the council majority started talking about regulating 2 miles south of Highway 11 all the way to the North Carolina line. Then just 1,000 feet south of Highway 11 to the North Carolina line, and then just the viewshed. At this point, the council was moving so fast, the public was left behind. I would bet, most on Highway 11 have no idea what is contained in this final plan. Most in the Heritage Area have no idea they are in it, and will be regulated.

I don’t like that the public was told a narrow corridor for 18 of the 20 months, and now the council is regulating a much larger area with this 11th hour expansion. There is no formal and widespread public notice being made of this plan. Now that the majority has a final plan, it should be formally presented to the public in a couple meetings. There the plan should be explained in detail and formal feedback taken (sign up here to speak). The map of the viewshed and who is in it, should be widely publicized. None of that is happening. The process at the end came off the rails.

Another reason I’ve voting “No”.