Recycle Center Improvements

By Alex Saitta

January 23, 2023

While most cities in the county have ended recycling efforts, the county effort at its recycle centers has improved.

The Centers:

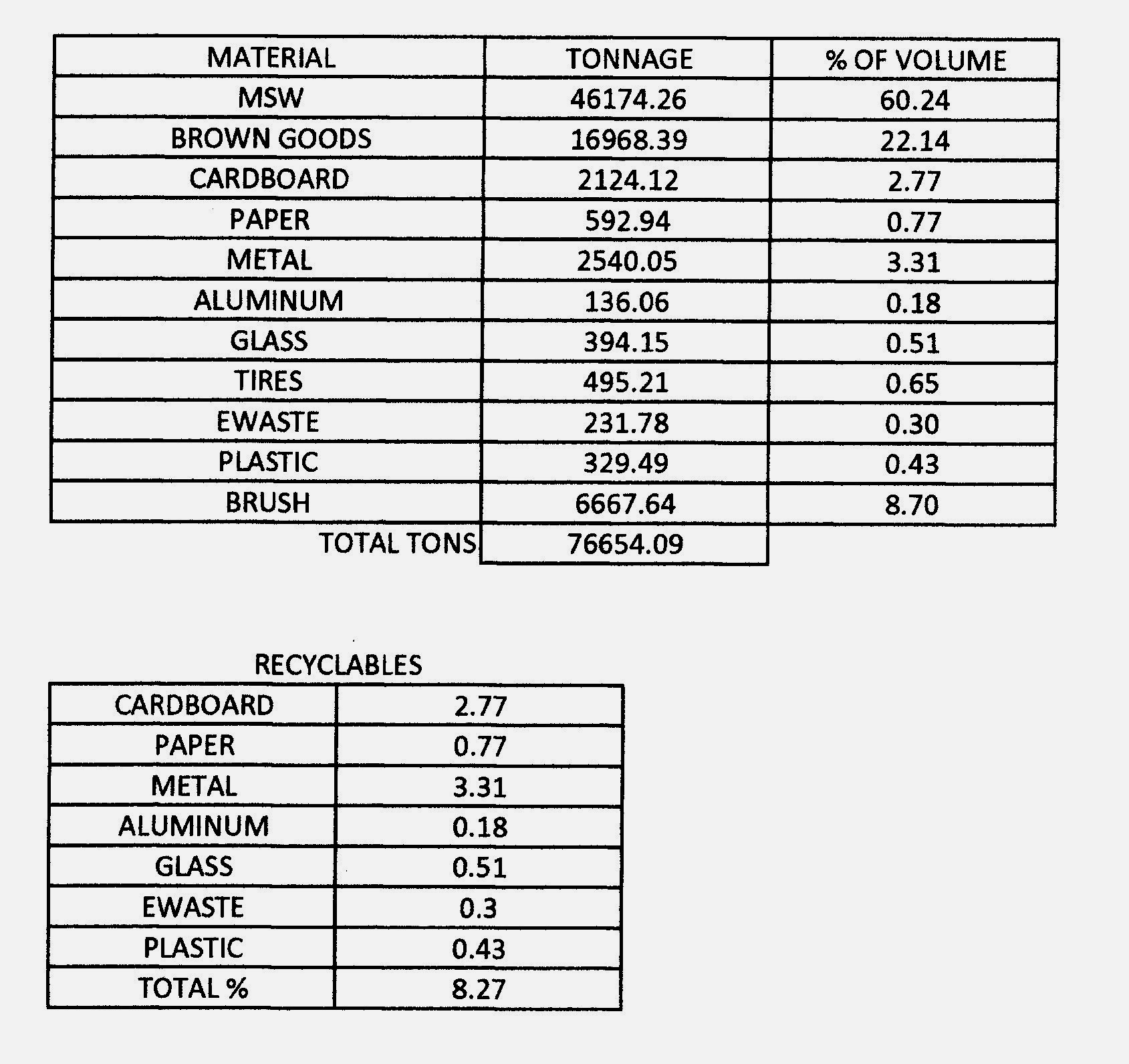

We've increased the help at the centers. The past 10 years house hold waste in the county is up from 36,482 tons to 46,360 tons. Total waste going over the scales – household, recyclables, brush, brown goods -- was 76,664 tons.

The front end of the process (recycle centers) has been one of my priorities. The county has two attendants working at 4 stations (Easley, Highway 183, Chastain and N. Old Pendleton). It is in the process of hiring a second attendant at the Midway Rd center. Given the lower volume at Table Rock and Dacusville, those will remain 1 man stations. Willow Springs needs a redesign, so 2 attendants there doesn’t make sense. I hope that will be taken up by the councilman in that area. The attendants were making about $10.50 an hour and received a good 15% pay raise, so that has helped too.

Recycling:

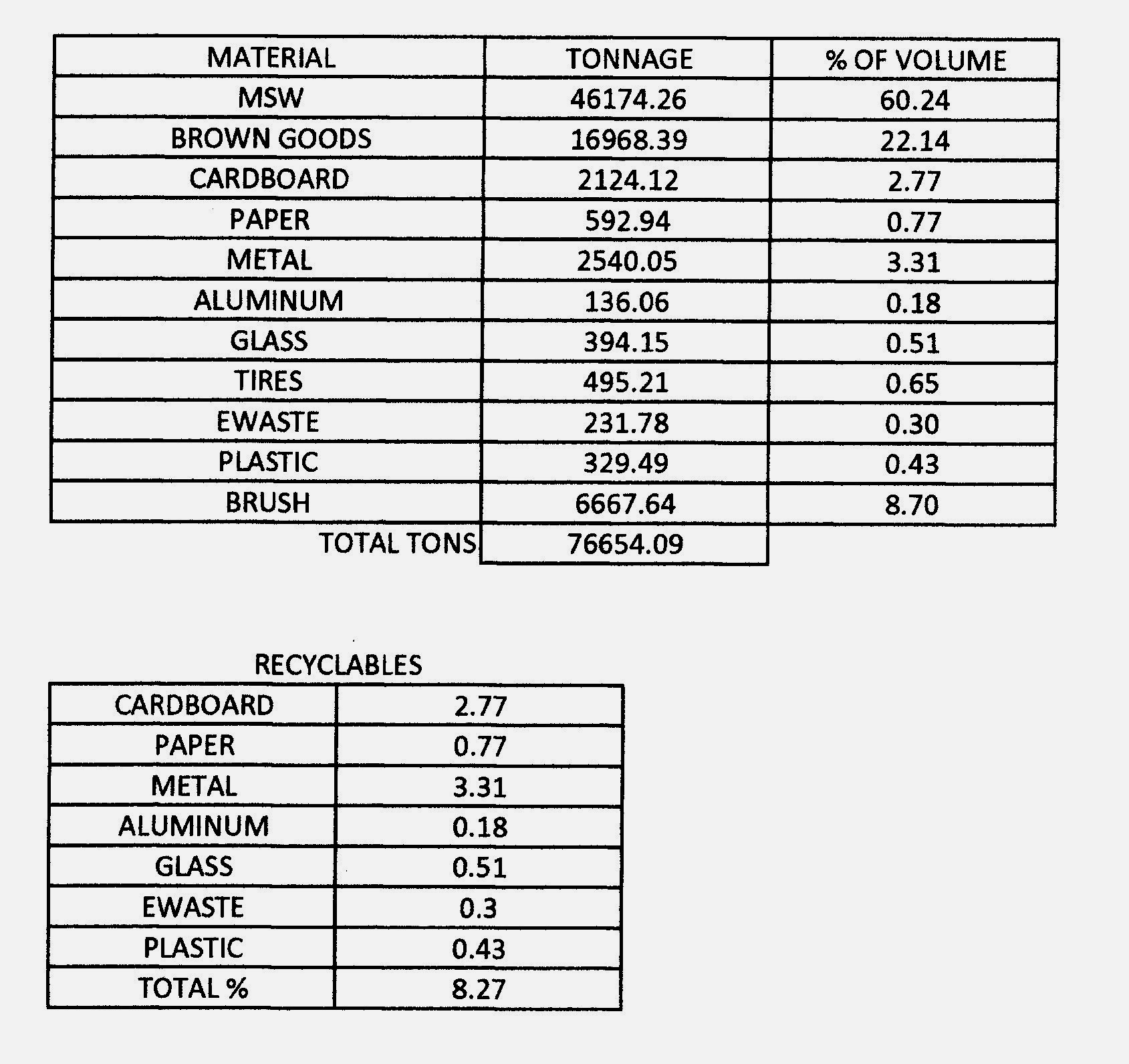

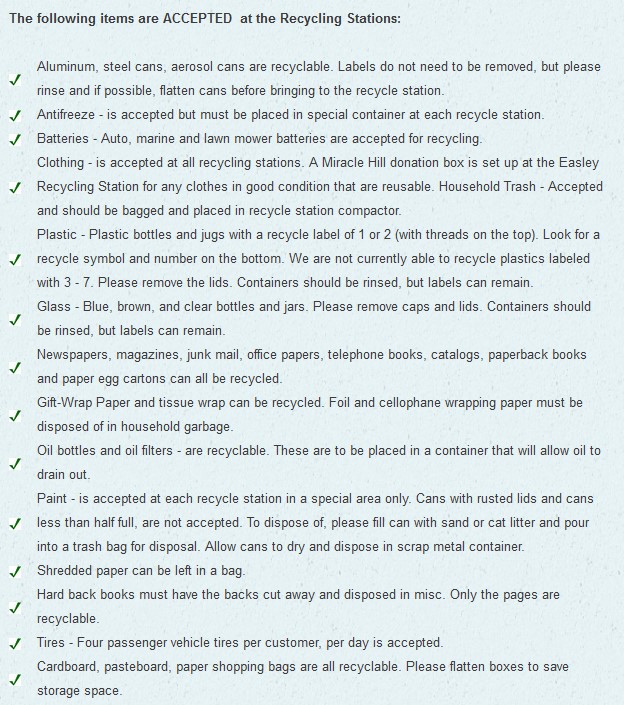

The county is making money on scrap metal, aluminum cans, cardboard and newspapers. It is losing money on tires, glass and plastics, but continues to recycle those items. The centers also collect motor oil, batteries, e-waste and things like that.

Recycling tonnage has increased from 4,842 to 7,445 the past 10 years.

Plastics:

The way the county gets the most money for its recycled materials when they are sorted, aggregated in one place, condensed and bailed. Plastics, for instance, the residents sort them (bottles and jugs) and put them in the blue baskets (see item 3). The attendants at all stations again are doing the second sort and then throw the plastics in the big blue bin. When full, a roll-off truck picks up the big blue bin, carts it off to the landfill where all the plastics from all the centers are dumped. When there is enough, the massive pile is condensed, so all the air is squeezed out, so it has more weight in less space. They bale the plastic and a vendor then buys the bales.

Glass:

The county using a Duke grant and has ordered a machine that will pulverize glass into sand. Once delivered, the county will use it to manufacture sand that it will use in things like sand bags, post holes, mixing concrete, etc.

Tires:

Not good. The county is still not shredding tires, though we bought that second shredder for that purpose. The shredder has been diverted to another task for now – resuscitating the current landfill. I was told the county will start to shred tires soon.

MRR/ Landfill:

While most of this write-up is good news, the landfill saga the past 6 or 7 years has been very bad news. First, way-back the deal was for MRR to buy and build a landfill off SC 93 and the county was to contract to dump there for the next generation. The current landfill, which the county owns, was nearing capacity and was slated to be closed. It was alleged DHEC and MRR then conspired to add coal ash to the landfill. The county pulled their permit and both sides lawyered up. The county then decided it would truck all its waste to Greenville and that was the working plan when I joined the council in January 2021.

Early in 2022, MRR and the county decided to settle the case. The county paid MRR $3.5 million for land around the MRR landfill. MRR had paid about $400,000 for that land. The county also agreed to give MRR a $3 million interest free loan to get the landfill up and running. About 3 months after the settlement, there was a 180 degree turn and the leadership decided it was not going to use the MRR landfill. The whiplash on that one was quite painful. Instead, the plan was to resuscitate the current landfill.

I get it. The county needs to own its own landfill. I said that for a while, but in negotiations with MRR the leadership should have settled only if MRR it agreed to sell their landfill to the county. Otherwise, the county should have taken MRR to court, where it had the case won I believe. In the end the county settled, paid out millions and didn’t get ownership of the landfill. I voted “No” on the settlement for that reason plus others. The settlement passed in a 4 to 2 vote (Trey Whitehurst voted “No” too). It was a terrible deal for the county.

Roll-off trucks:

These are the trucks that pick up the blue bins from the centers and bring them to the landfill. There are 4 good roll-off trucks and 3 old, older and oldest spars that they use in the yard or will add 1 to the road on Saturdays and after holidays. Last I heard, the drivers’ slots have been filled and drivers are fully staffed. That is an improvement on both fronts.

Blue Bins:

At last count, there are 102 blue bins. We bought 20 new ones with the COVID money and have been replacing 4 a year. The ones they replace are either then used in the yard or scrapped. If you look closely, you’ll see a lot of the new blue bins at the recycle center.

Compactors and Cans:

These are the compactors that slam the household trash into the connecting blue containers or can. I was told they have 16 compactors at centers and 1 next to MSW transfer station in the yard. The county is buying 2 new compactors and 4 cans a year. The compactor at Table Rock was fixed and should be running good now.