"Iceberg!" The Horizon Is Clear

by Alex Saitta

October 20, 2023

Introduction:

In 2009 during the Great Recession I wrote a collapse was not likely as confidence in the government, more so their ability to continue to borrow, remained high. I predicted a long slow economic slide that could last as long as two decades, that would culminate with parts of the financial or real economic collapsing in some way, shape or form (see the Jan, 20, 2009 write-up).

13 Years In:

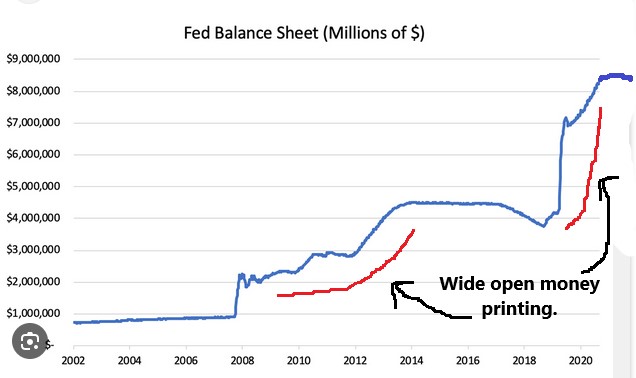

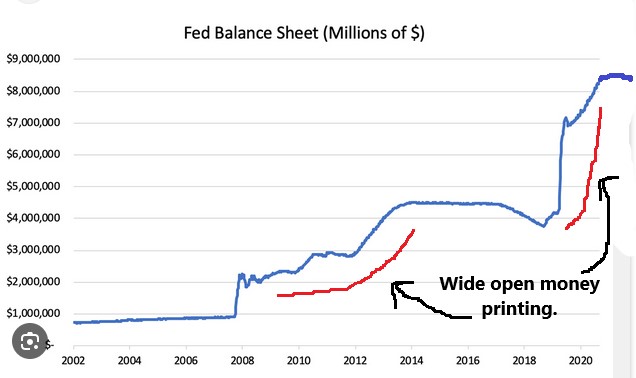

Here we are 13 plus years later, and the economy is in better shape than I predicted. I thought by now we’d be bogged down with zero growth and moving from mini crisis to mini crisis. I did not see the extraordinary steps the government would take to prop things up with all this stimulus — record borrowing, printing massive amounts of money (picture 2) and even giving away cash. But due to the laws and principles of economics — particularly overspending and debt, things would continue decay. You could not see the ending or what it will look like scanning the horizon, but you knew with all this borrowing in the public and private sectors, where the world economy will end up.

Analogy:

It is like we are on the RMS Titanic, the iceberg is out there and we are heading toward it, but it was not yet in sight.

In Feb 2020 I wrote the slide was accelerating (see Feb 20, 2020 writeup). We reached another milestone recently, I think. Now, if you look closely at the horizon, you can actually see what is going to happen. Analogy-wise… the guy in the crow’s nest is screaming out his first, “Iceberg!” It is clear, big and dead ahead to see, except for the blind as things are now light and the skies are crystal clear. And Joe Biden, Mitch McConnell and no one really only knows in the House, are our Captain Smiths. I think we need a miracle.

Other than Rand Paul, our leaders either don’t care or understand debt, refinancing and compound interest. Heck, Congress/ President actually removed the debt limit or the last restraint on deficit spending. Annual deficits will only get bigger from here, quickly. I remember David Stockman saying in 1985, we’ll have $200 billion annual deficits as far as the eye can see. Now it is $2, $3 and then $4 trillion deficits as far as the eye can see. The deficits and debt situation is out of control. Total debt is $33 trillion, but more importantly, interest on the debt is $725 billion and growing fast. As I wrote a few weeks ago, 41% of US Treasury debt has to be refinanced over these 3 years. Quickly interest on the debt will rise above $1 trillion a year and it accelerates from there.

The Horizon:

We can not pay it now and it will only get worse. Income is not high enough. It is getting harder and harder to borrow it to plug the gap. The US Treasury is borrowing $2 trillion in new debt every year. They are being forced to refinance trillions more. The appetite to lend or domestic savings is not that much. So unless the Federal Reserve restarts gobbling up Treasury bonds with printed money, interest rates will continue to rise.

The Fed stopped printing money a year ago (see pic above for most recent data), and all the Treasury borrowing week in and week out has caused interest rates to rise. Higher rates are creating two crash course situations. One, it will slow the economy and put us in a recession. With 60% of households living hand to mouth, job loses will put many on the street, and ignite social unrest in places. Two, individuals and corporations are also in debt up to their eyeballs. They have to borrow and refinance at higher interest rates. They don’t have the income. It will result in defaults.

Rates & Bad Things:

There are 100 many bad things that are unfolding as interest rates rise. At some point, it will become too much, and our leaders will damn the torpedoes, and Fed will be forced to crank up the printing press again and keep them running — re-igniting perpetual inflation. Like every banana republic, these fools will try to print their way out of the mess they created the past 5 decades.

Between here and out there where parts of the economy begin to falter, break down and then collapse, the government will fire a couple bullets we have not seen before, to stabilize the descent. When the stock market rolls over, the Fed will begin to buy stocks for the first time. That will hold things up for a while. In a last act of desperation, negative interest rates will follow — force feeding credit down the throats of a world economy OD-ing on credit. In the end, it is now clear inflation takes the economy down in my opinion.

P.S., the yield 10 year Treasury is speeding upward, now at 4.99%. The high in early 2006 was 5.25%. Surely that will stop it and trigger a correction.