Pickens County Performing Arts Foundation

by Alex Saitta

September 22, 2024

Background:

It is a long history... bear with me. About 10 years ago the school district sold the old Liberty Middle School to the county government. The county renovated the complex and turned the Liberty Auditorium into what is known as the Pickens County Performing Arts Center (PCPAC).

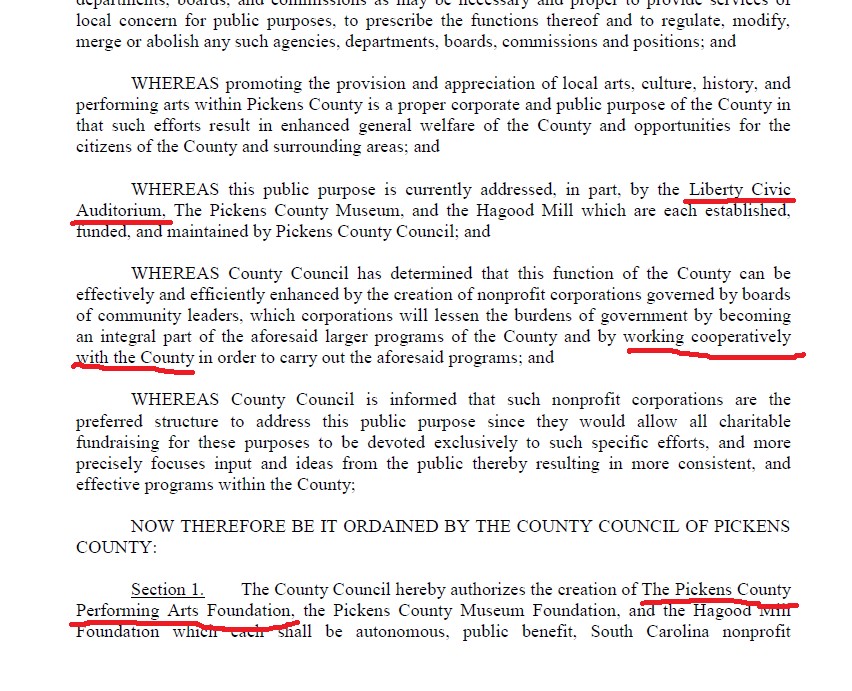

The county and the foundation board worked “cooperatively” to book acts, put on shows and raised money for the PCPAC. The foundation was created by the county council in 2017 (see item 1), the council put board members on the board, and gave the foundation $68,000 in seed money. The foundation board is to file an annual tax return, have agendas, post minutes and renew its state registration each year with the Secretary of State’s office to be eligible to raise money and operate.

Falling Bank Balance:

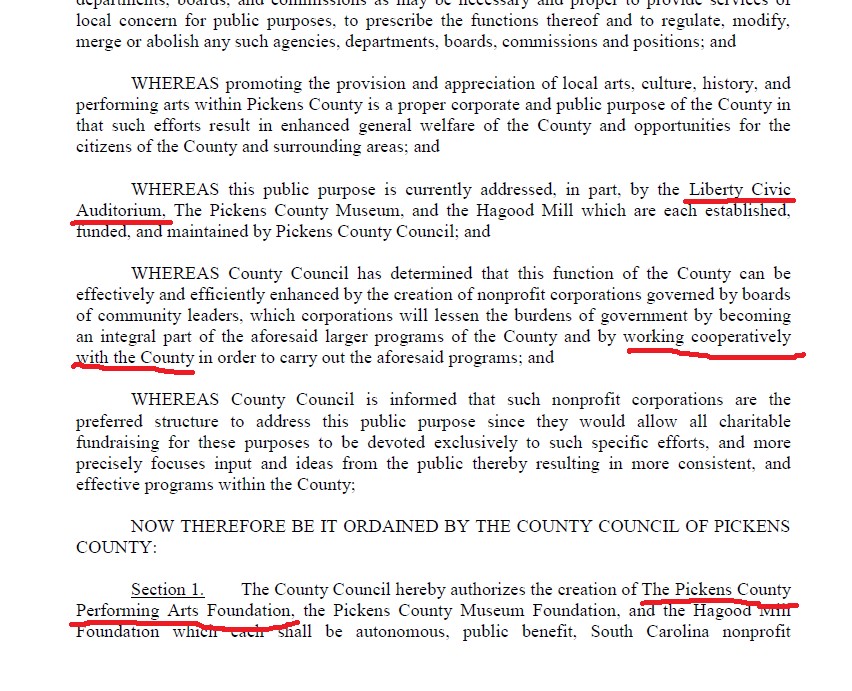

After I was elected, I came across the foundation’s tax returns (all non-profits have to file and their tax returns are on the IRS’ website). I noticed their bank balance had fallen from $70,165 in June 2019 to $29,900 a year later (see item 2). I asked, what happened during that period of time? (Today that balance is $16,000 - scroll on down).

No one seemed to know nor could answer, as most of the officers or board members of the foundation had resigned in 2020 and 2021. I wondered how could the foundation board be voting to spend money from its account at such a high rate when most of the board had resigned, and two still on the board told me they were not meeting, surely not meeting regularly (minutes show only 2 meeting in 2 plus years).

Mine were legitimate questions.

State Registration/ Federal Tax Return:

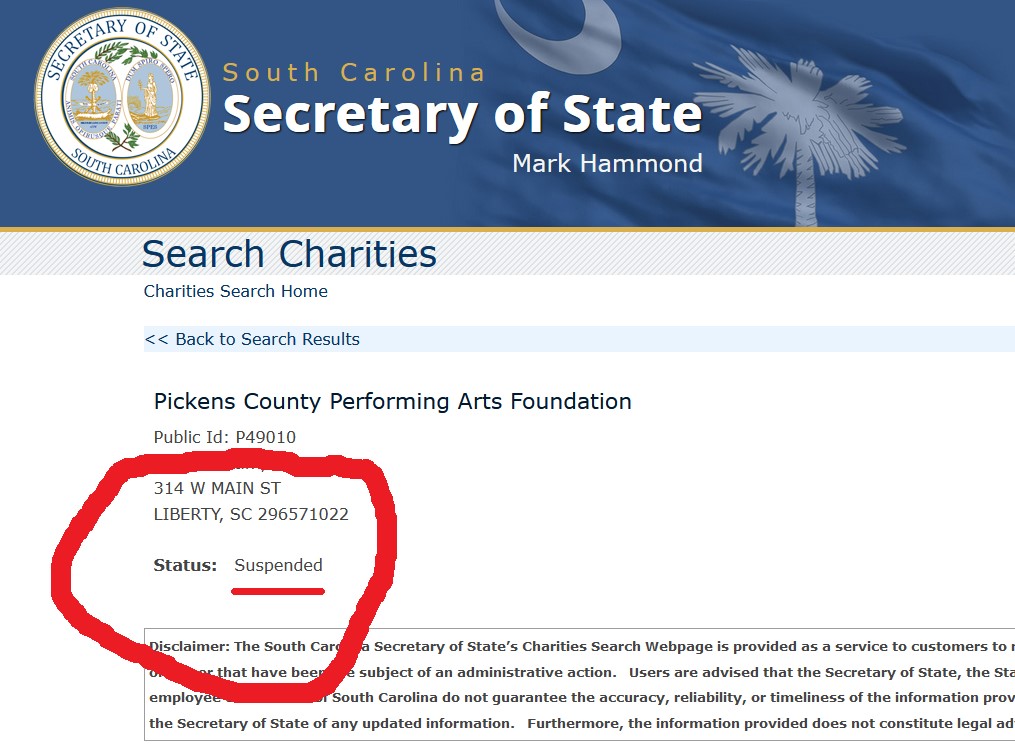

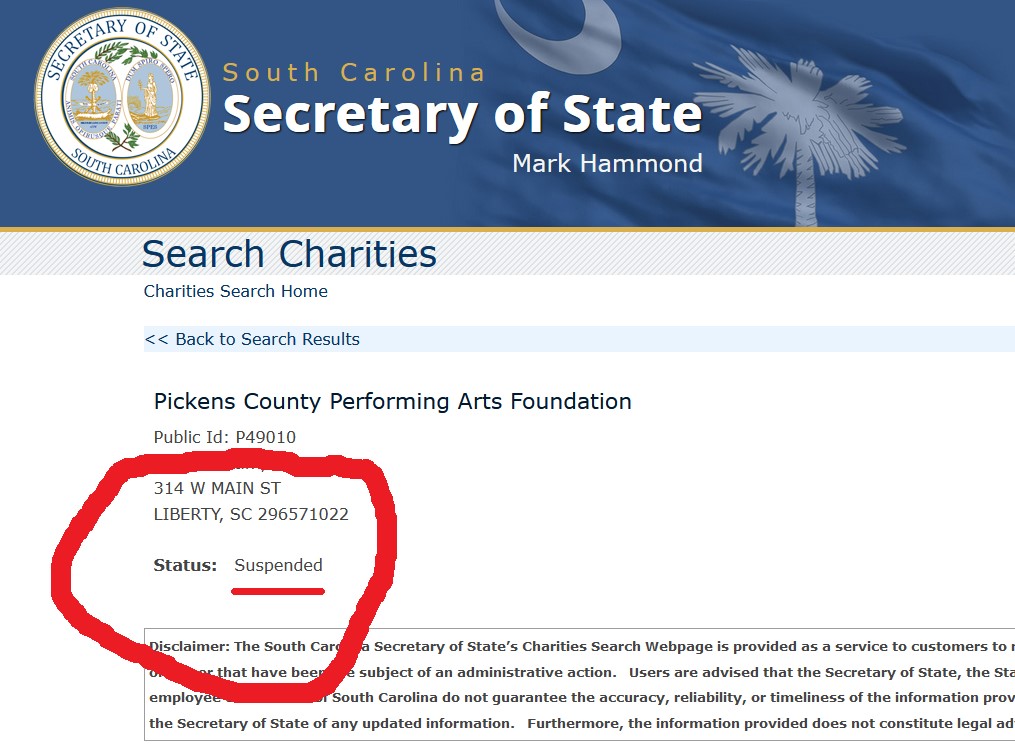

In addition to filing annual tax returns, all such organizations are required to register with and then annually renew their registration with the state. The secretary of state posts the status of the organization’s registration on their website.

In 2021, when I looked at the South Carolina Secretary of State website and then called the office, I saw and then was told the foundation’s annual registration had not been renewed and expired. I then called the IRS and was told the foundation had not filed its last tax return and it was overdue as well. I also brought this up in county council meetings.

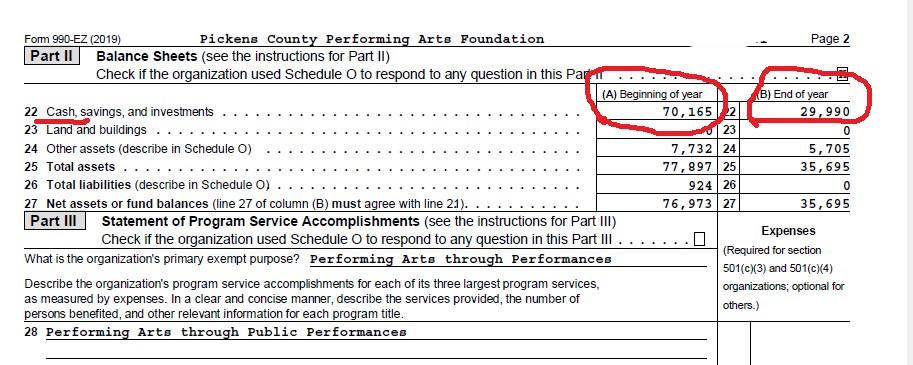

In early 2021 the county council voted 4 to 2 to turn over the management of the PCPAC from the county tourism department to a private management company. That company has been running the PCPAC since. Remember and I want to stress, the management company is different and separate from the foundation. For the most part the former manages the facility, and the latter raises money and generally promotes the PCPAC. I voted “No” on this management switch as I had too many unanswered questions about the foundation, its foundation board, finances, lack of compliance and it was quite integrated with the operation of the PCPAC (see item 3).

In July 2021, the Pickens County Performing Arts Center requested $15,000 from the county council in ATAX money. It was signed by an individual listed as the “Foundation Chair”. I was like, huh? I gathered the foundation was defunct, so I asked more questions.

My Request For Records:

In addition to up to date tax returns, up to date state registration, and minutes of meetings, in July 2021 I asked via email to see the foundation’s bank statements from January 2020 to mid-2021, copies of checks written out of the foundation’s account – to whom, for what and who signed them during that period.

The answer I got back at a county council meeting was there really was no board to ask for those things. Worried, I asked in January 2022, does anyone know where the foundation checkbook is? Four months later I asked again and was told a foundation board member handed over the checkbook to the county attorney.

Fast forward to 2023:

Last week I learned the foundation board was reconstituted with new members a few months ago, by someone, somehow, I don’t know. I looked on the website and the Secretary of State has suspended the foundation (see item 4) and it can not solicit funds. I called the Secretary of State’s office and it said the foundation’s registration was not renewed in 2021, 2022 or 2023, and the foundation owes the state $4,000 in fines. By law the foundation has to file their latest tax return with the secretary of state too, and I was also told it has not.

I called and IRS and looking at their website, I think the foundation is behind 1 to 2 years on filing its tax return. I was told late fees are accruing. The IRS did not tell me the amount, but I estimate the late fees are a few thousand dollars. As a rule 5 months and 15 days after the filing deadline of a 990 form, the penalty on a late return is $20 a day. The IRS will revoke an organization’s 501c3 status if tax returns are not filed and are late for 3 years.

Going Forward:

Reading the minutes of the new board, I credit them for trying to piece together what happened, assess the situation they blindly inherited, as they are trying to gather past records from 2020, 2021 and 2022. I can see from their August 8, 2023 meeting minutes, the foundation’s bank balance is $16,000.

At this point, the situation needs to be looked at by the county government with cooperation of this new board – tax returns filings, the suspended state registration, the coming and going and coming board, late fees owed to regulators and lack of transparency which is needed in this situation as this foundation and the county are linked together. Additionally, if public is going to give money to this foundation again, all have to be confident everything is in compliance, settled with regulators and look-back at what really was going on.