Reassessment 2019

By Alex Saitta

February 10, 2020

Introduction:

2019 was a property reassessment year. The county council said most will have their taxes lowered this year. They think because the rate was rolled back, it was a tax cut. Thatís sad and shows you how those on the council and even the school board do not understand the reassessment process and how it works.

How Reassessment Works:

To understand how reassessment works, you have to examine code 12-37-251(e) of the state law that governs reassessment: Rollback millage is calculated by dividing the prior year property tax revenues by the adjusted total assessed value applicable in the year the values derived from a countywide equalization and reassessment program are implemented. This amount of assessed value must be adjusted by deducting assessments added for property or improvements not previously taxed, for new construction, and for renovation of existing structures (i.e., growth for that year).

This is gobbledygook to most, including our county councilmen and school board trustees unfortunately. Therein lies part of the problem too, which Iíll discuss later on. Basically, what 12-37-251(e) dictates is taxing authorities cannot reap a tax windfall from existing properties due to reassessment, and to insure this they must roll back the tax or millage rate on operations by the amount of the higher assessment.

An example will explain...

For example, letís say in 2018 the county had 10 homes that were worth $100,000 each and the tax rate was 100 mills and they collected $10,000 in taxes. Then in 2019 the county reassessed those homes and each was worth $110,000, and an 11th home was built and it was valued at $110,000 also.

Code 12-37-251(e) states since the 10 existing homes rose from $100,000 to $110,000, taxing authorities must roll back their millage tax rate by an amount so they receive no extra revenue on those 10 existing homes they reassessed at a higher value.

To calculate the rollback millage rate for 2019, it is a simple division calculation. Start with the tax revenue of 2018 of $10,000 and put that in the numerator or the top of the calculation.

In the denominator or the bottom of the calculation start with the value of all the property in 2019 or $1,210,000 (11 homes times $110,000). They take out that 11th home or the growth because the taxing authorities are entitled to all the tax revenue from new construction. (Remember in the law above it says ďadjusted by deducting assessments added for property or improvements not previously taxedĒ.) So in the denominator is the existing 10 homes times $110,000 each yields $1,100,000.

$10,000 is divided by $1,100,000 and that results in the rolled back millage rate for 2019 of 90.9 mills. So 90.9 mills times 10 homes of $110,000 each yields revenue from those same homes of $10,000 in 2019 as it was in 2018. No windfall from the higher valuation of those existing homes.

In a perfect world, that is how it is supposed to work, but it is not the whole story.

In Perfect World ó All Property:

In a perfect world when you look at all property, after the 2019 reassessment the total value in the county rose by 11%. There was about 4% in growth, exempt property (like schools) and abatements and that is all removed from the millage rollback calculation. As a result, the total millage rate should have come down by 7% year over year.

That didnít happen. The total millage rate for the county government and school district was 238.2 mills in 2018. It was rolled back to 228.7 in 2019 or about a 4% drop. Thatís it.

Why? Code 12-37-251(e) millage rate rollback is only required by law for millage on operations. All taxing authorities levy a tax for operations and debt. The taxing authorities have a choice to roll back on debt millage.

In A Perfect World ó One Property:

In a perfect world if you looked at one property that didnít have any additions or improvements, it would have been reassessed higher by 7% on average. In turn, the tax rate would have been rolled back about 7% and the tax bill on that property would have been the same in 2018 and 2019.

In reality, though, the 7% increase in property reassessment for existing properties was an average. By law they can raise values by as much at 15%. So some properties saw their reassessed value rise 10 to 15%. Plus, if you bought your house this past year, letís say at a price of 30% higher, the 15% cap doesnít apply, so your house will be value 30% higher year over year.

The total tax rate was rolled back 4%, so houses reassessed at 10%, 15% or 30% higher saw a significant tax hike.

Like I wrote above, more than 75% of the properties in the $125,000 to $175,000 range saw their tax bill go up. Why? Part of that was, many homes in that range saw their reassessment go up close to 15% and the millage rollback was only 4%.

A Real Life Example:

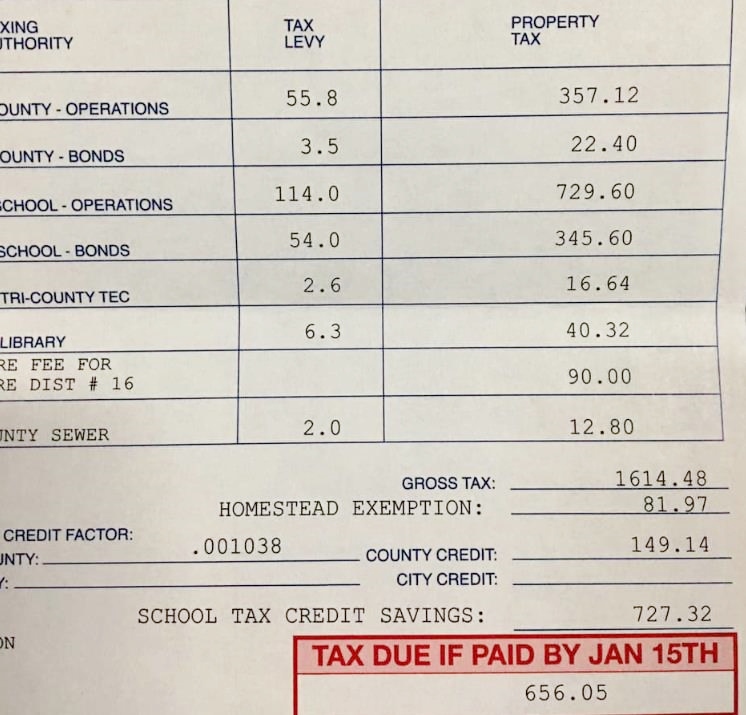

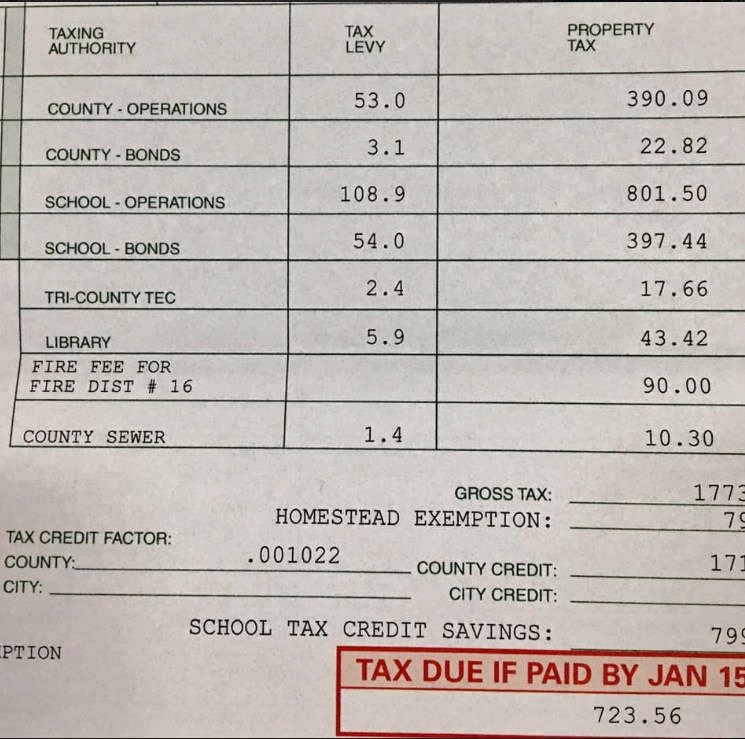

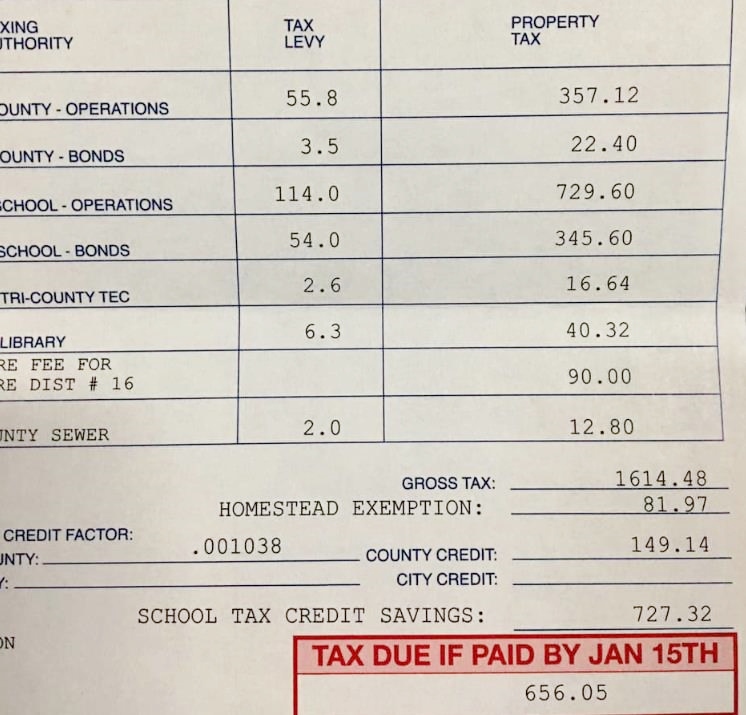

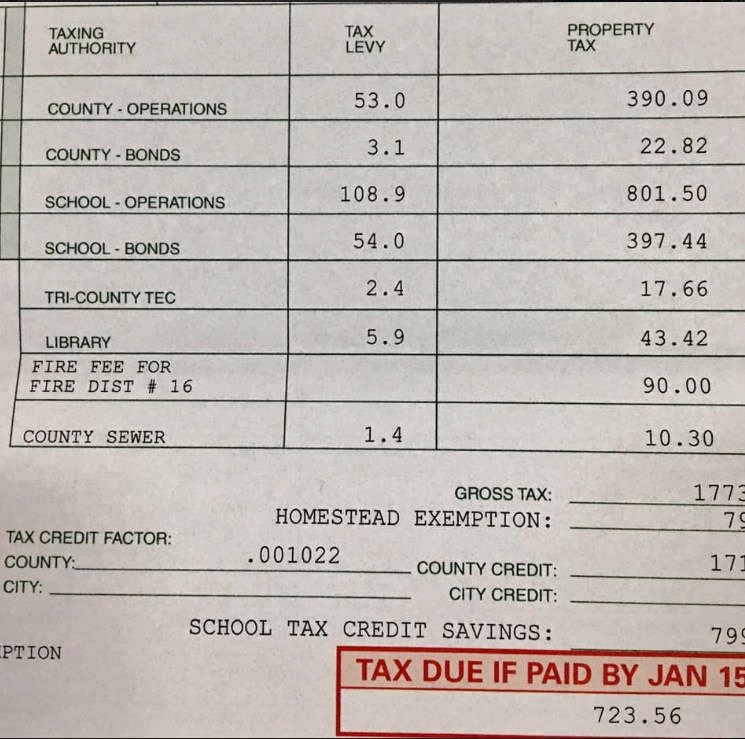

Look at these 2018 (on left) and 2019 (on right) tax bills for a house of a person who posted their bills on Facebook, wondering why their tax bill was higher in a reassessment year. You can see this homeowner got about a 10% tax hike.

Focus on the second column on both bills. In six of the eight taxing categories taxes are up, one was unchanged and one was down. The biggest tax increases came from county government operations from $357 to $390, from school operations from $727 to $801 and then school bonds from $345 to $397. That is a tax hike. It is not back breaking, but it is a tax hike.

Add in a higher fire fee that occurred in some areas, and that will add to your 2019 tax bill too. In my area, Pickens, the fire fee was raised by 25%.

While the council and school board complied with the rollback law, I could tell you early on looking at it all, I knew most in the county and particularly in the $100,000 to $200,000 range were going to see their 2019 property tax bills higher.

Lack Of Experience:

The councilmen and trustees approve their tax rates each year, including reassessment years. They should have known most were going to get a tax hike in 2019.

I went through three property tax reassessments when I was on the school board from 2004 to 2016. I know the process. For example, in 2005, I understood the rollback formula, and all the factors and realized the millage rollback was not enough and the school board and county council over-collected. I brought it to the auditor, he agreed and both were ordered to give back the over-collection back.

This is the first reassessment for all the school board members. This was the first reassessment for 4 of the 6 county councilmen. They simply donít understand it and the right hands just went up in approval.

Flush With Cash:

Looking at the high cash positions and how much theyíve over-collected the past few years, both the school board and county council could have rolled back the millage rates much more to avoid so many tax hikes. Not one councilman or trustee even brought up this point.

Both the county council and school board borrow money. As a result, their creditworthiness is evaluated by the rating agency Standard & Poors. At the end of the fiscal year, S&P wants to see a cash balance in the general fund account between 15 and 20% of the annual general fund budget.

Letís look at the respective financial audits of 2019 and their cash balances. The countyís budget is about $45 million. On June 30, 2019 the county council had an unassigned cash balance of $24 million or 53%. That is way above the 15 to 20% range. In sum, theyíve over-collected, keeping all the money and are spending it on this and that. They could have rolled back their millage rate more and returned some of that excess to the taxpayers, putting a lid on the number of taxpayers who got a tax hike this year. That didnít happen and none of the councilmen advocated for it.

The school districtís budget is $120 million. On June 30, 2019, they had an unassigned cash balance of $30.5 million cash on hand or about 25%.

Look at the school districtís building fund (the one they use to replace roofs and HVACís, repainting, repaving and light renovations). It has $10.75 million cash in it. For the most part that is funded with annual borrowing and you pay for those bonds through school bond millage tax rate. The school board didnít roll back the 54 mill bond tax rate one bit, so if your house was reassessed 10% higher, you got a 10% tax increase for school debt.