Growing Debt Still A Problem

February 24, 2020

By Alex Saitta

Unlike in the early 2000’s, I don’t talk about the debt and deficit much now a days.

Back in 2005 I wrote a piece called, “The Path To Economic Crisis”. I thought it was a critical time then and in fact a crisis was only 3 years away. A financial and economic crisis hit in late 2008 when stocks halved, banks were failing and the Great Recession hit.

I looked at the government response and in 2009 came to the conclusion a collapse was not likely anytime soon. The government demonstrated it was going to take any measure it had to in order to avoid a collapse. From TARP, to chronic deficit spending, to printing oodles of money, they were successful in avoiding a collapse. We got a recovery/ expansion but due to the building structural problems (debt, declining work ethic, regulation, and printing of money) I thought we’d slide economically for up to 20 years, and then the world economy would collapse.

If you asked me in 2010 where will we be in 2020? I would have said by 2020. bogged down in chronic recessions. While growth has been sub-par (item 0), I was wrong.

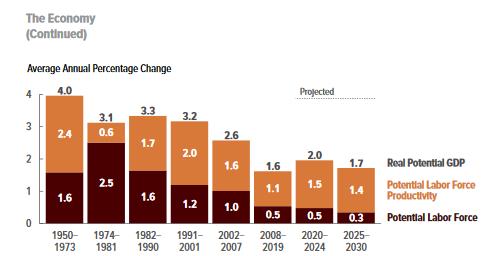

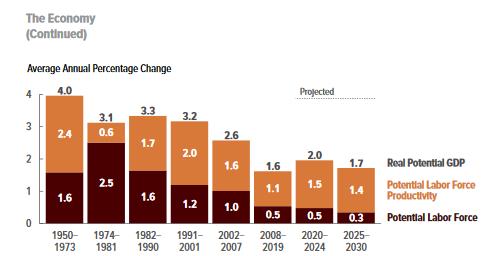

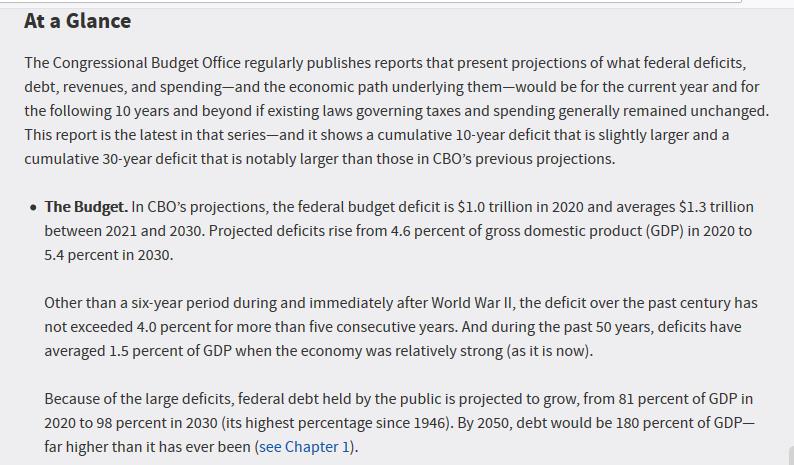

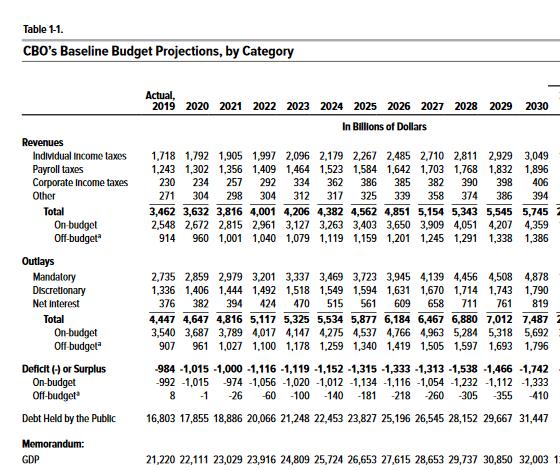

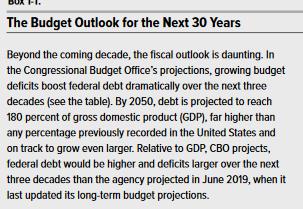

But this has not killed my long-term forecast of a 20 year slide and then a collapse. It is ultimately going to be debt ignited/ driven and debt is piling up at the corporate and government levels and even in households. The CBO just came out with its update on the Federal deficits and debt looking out 10 and 30 years. First the US Treasury is looking at annual $1 trillion deficits as far as the eye can see (item 1). Just since their last forecast (in 2019), long-term debt projections out to 2050 have gotten 30% worse (item 2). The problem is accelerating and likely to be worse than estimated.

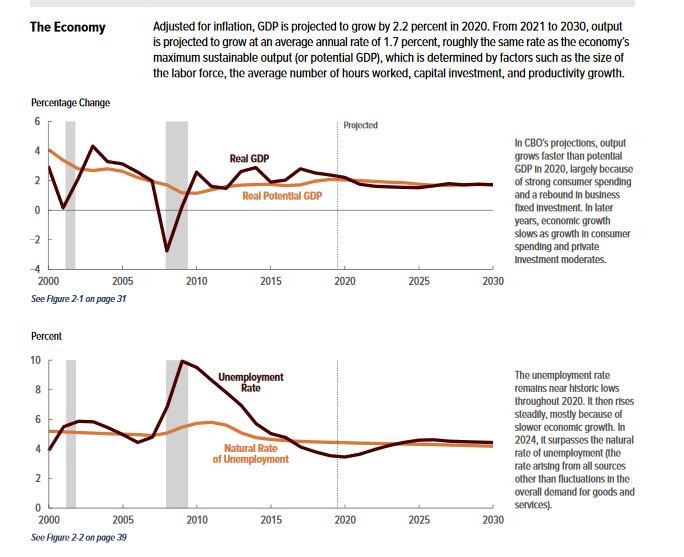

Their projection is based on rosy GDP projections. The CBO doesn’t foresee a recession over the next 10 years (item 3). So basically no recession from 2009 to 2029. As a result, their forecast assumes federal revenue will grow every year (item 4). That’s unrealistic folks, so the deficit/ debt is likely to be larger than the CBO is forecasting.

Reading their comments (item 5), the CBO sees daunting problems after 2030. I think it hits sooner, sometime in this decade. My guess something triggers it. Maybe it’s Bernie in 2020 or 2024. Political unrest or an economic event like recession and a G8 country defaults. This a pile of gasoline soaked rags vulnerable to a careless strike of a match.