Massive Tax Hike By County Council

Why I Voted “No”

By Alex Saitta

September 20, 2021

Introduction:

On September 13, the county council voted 5 to 1 to raise property taxes by 9.6 mills or 18%. I think this was the largest property tax hike in the history of our county government. This will replace the $20 road fee, but overall this record tax hike will raise about $3.5 million more in higher taxes annually. I voted "No":.

The county government was charging and collecting a $20 road fee and put that $2.3 million dollars toward maintaining roads, both county owned and city owned roads. In 2019, the county modified the agreement giving $600,000 of county moneyt to cities to pave city owned roads.

Three months ago, the state Supreme Court ruled charging road fees violated state law. As a result the county government stopped collecting the road fee, and the deal of giving county money to cities to pave city owned roads became null and void.

Whopping Tax Hike:

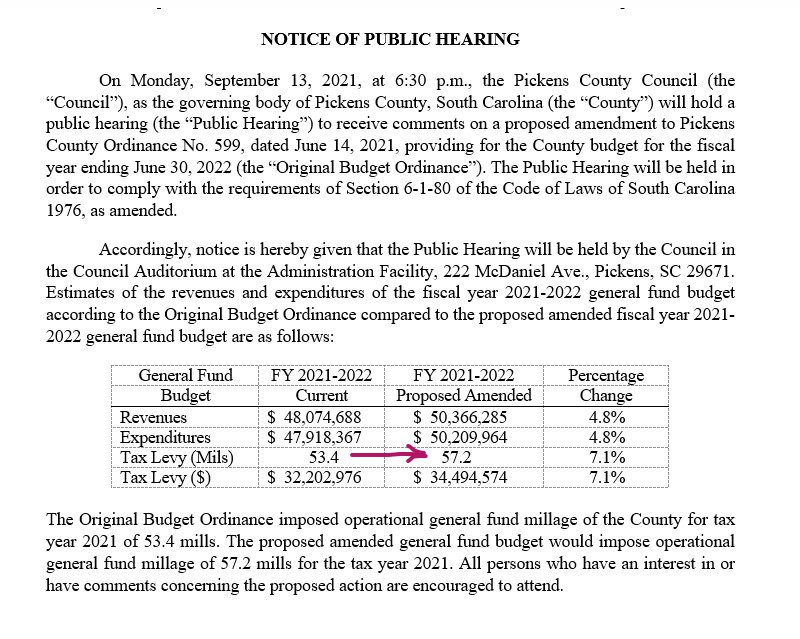

The 5 to 1 vote raised property taxes 9.6 mills to replace the $20 road fee AND raise an extra $3.5 million annually in taxes. If you look at the meeting notice, it was for a 3.8 mill tax increase. This whopping 9.6 mill tax increase was cooked up in the final minutes of the third reading. I was there and it shocked me. Surely, the public didn’t see this coming.

My county tax rate records go back 25 years. The largest tax hike was 5 mills in 1996 and 4.5 mills in 2004. Likely this 9.6 mill hike is the county government’s largest in history.

Specifically, the increase in county operations was 10 mills, less a 0.4 mill reduction in the library tax, equals a 9.6 mill tax hike from the county.

Around The Limit:

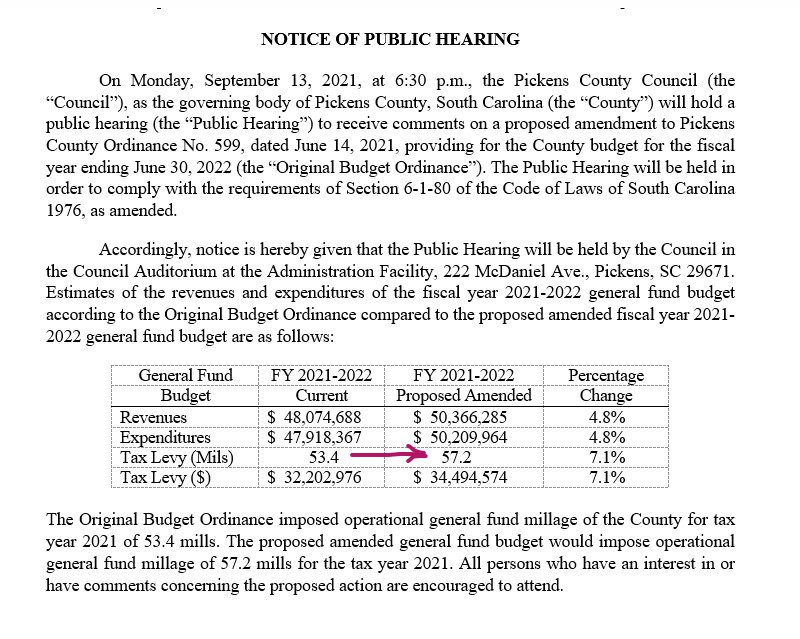

State law 6-1-320 caps the annual tax increase to 5.3 mills. There are a few exemptions to the cap, which deal with emergencies or unusual circumstances. Specifically, the law says the council can raise taxes more than the legal cap to “maintain a reserve account”. The purpose of this exemption is for situations like the county gets hit with a big expense, it doesn’t have a cash reserve, and it has to borrow to plug the gap. So the county doesn’t get caught short again, the next year it can raise taxes above the cap to fund a reserve for such emergencies in the future.

The county general account (which taxes were raised about 10 mills), has about $23 million in it that is not promised nor needed for cash flow purposes. It is a massive excess or reserve by anyone’s definition.

Expenses paid from the general account are things like roads, personnel, solid waste and EMS. If the expenses of any of these departments run over budget, they tap into the $23 million excess sitting in the general account. They don’t need separate reserve accounts for each department. It is kind of like your car. The one spare serves as the spare for all 4 wheels. You don’t need nor would want to drive around with the complication of 4 spares, one for each wheel.

If the true aim was solely to create a dedicated reserve account for roads inside the general account, they could have moved $3 million over from the $23 million in cash without the extra tax hike.

Savings:

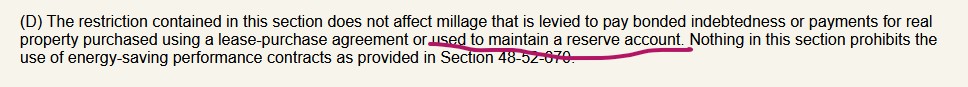

Here is the cash balance in the general fund account as of the end of the past year.

$38.0 million balance. Assigned of $5.8 million means it is owed or pledged to be spent. $1.1 can't be spent at all. That leaves $31.0 million unassigned. From that, for cash flow purposes or emergencies you need about $8 million. Meaning, if you have an expense before the revenue comes in you need extra cash to make sure you don't bounce checks.

The savings is the net of $23 million ($38.0 - $5.8 - $1.1 - $8 = $23 million). That's savings or some would call an over-collection.

That $23 million and to a lesser extent the $8 million are there as reserves for all departments in the general fund beit roads, EMS, solid waste, personnel, etc. Roads has not had its own reserve account before, and doesn't need one because all department can tap into this big reserve.

Legal Scheme:

I think the reason they created this unnecessary reserve account within a massive reserve was to get around the cap. If you look at the first and second readings and the other options at third reading, a reserve was not created. It was only created in the options that blew past the 5.3 mill cap. Creating this additional reserve account, in the minds of the legal staff allowed the council to blow past the millage cap in order “to maintain a reserve”. I saw it as a legal scheme or maneuver to get around the cap. Not what I'm about.

Think about it... Using that logic, next year they could create a separate reserve account for the EMS department, inside the general account. Again, this would allow them to blow past the millage cap in order to fund it.

The following year they could create another reserve account, this time for solid waste. Then they could blow past the millage cap again in order to “maintain that reserve account”. In my mind this approach of creating a reserve account within a reserve account to get around the cap violated the purpose or intent of the millage cap law, which had exceptions for emergency situations. No emergency here.

Think about this as well. The $23 million they already had in reserve in the general account was due to over collection of taxes. Evidently $23 million wasn't enough. So another reserve account was created and they reached above the millage cap of 5.3, raised it 10 mills and took even more from the public. Now they have $26 million in reserves. Swimming in cash. There was no emergency here to warrant blowing past the millage cap.

Intent vs Letter?

The law doesn't say you can get around the cap to maintain reserve accounts, but to maintain a reserve account (singular). The question here is does the action comply with the letter of the law? I don't know.

As an elected leader I always felt we have to comply with the letter of the law and the intent and not try to split hairs to get around things.

Look at the other exceptions to uncover the intent of the exceptions -- a natural disaster, a deficit the year before, compliance with a court order that springs up and the body has to pay out lots of money, some event that cuts county revenue 10%, to comply with some federal or state mandate, etc... emergencies or unforeseen events.

There was no emergency or unforeseen event here. As elected leaders I felt we need to comply with the letter of the law and the intent as well.

Tax Bills:

This 9.6 mills hike will hit occupied homes, rentals, vacant land and business property flush on the jaw Oct 1.

Don’t forget Oct 1 some fire districts are seeing significant fire tax hikes and that will hit homes and businesses as well on the Oct 1 bills. For example, Dacusville Fire is paying $98 per house now. Oct 1 it will go up to $90 to $230 depending on the sqf of your house; Rocky Bottom $45 up to $90 to $230; Holly Springs $70 now up to $90 to $230; Central $72.50 now to $90 to $230; Easley $81 to $90 to $230. Business hikes were worse.

The school district also went up 1 mill too, so Oct 1 will not be a good day.

Vehicles will fare better, but those bills will be send out the next 12 months. They will get hit with the 9.6 mill tax hike, but shed the $20 road fee which will give those assets a small tax hike or tax cut, depending upon its value.

But on balance, tax revenue is being hiked by $3.5 million and someone will pay it. It is mostly going to hit businesses, higher priced homes and cars.

The Cities:

Hey, I understand the politics when a city is a big part of your district. I see why other councilmen in the past have voted to give away TIF money to cities or school board members have pushed to give way a free building worth a million or so to their local city. However, this was a step too far -- handing over $600,000 in cash annually to cities to provide a city service. The county does not have enough money to pave county owned roads. Why are we giving county tax dollars to fund city owned roads? Gosh, across all accounts Easley has $17.9 million in the bank. Clemson $16.8 million.

The county government is not responsible to pay for city services -- not city police, not city trash pick-up, not city roads. The lure of currying favor with your local city is a strong thing for any councilmen or board member to resist, so I’m worried this arrangement will be re-established in the future.

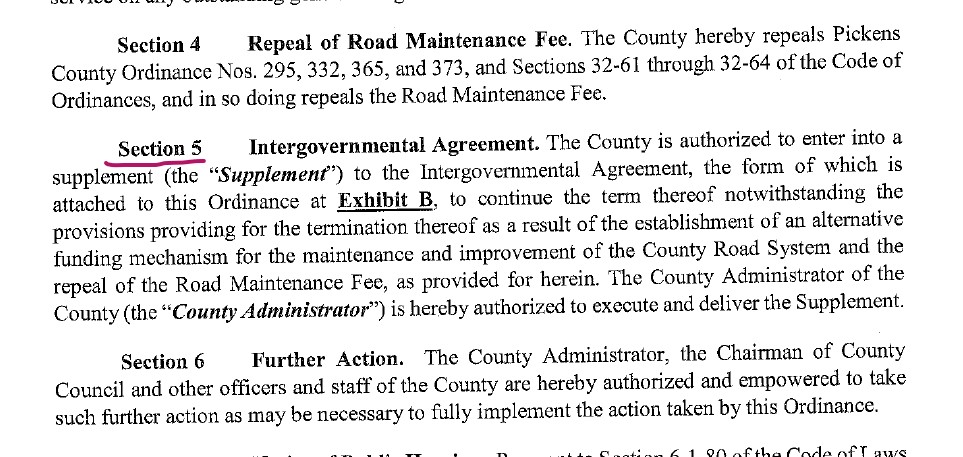

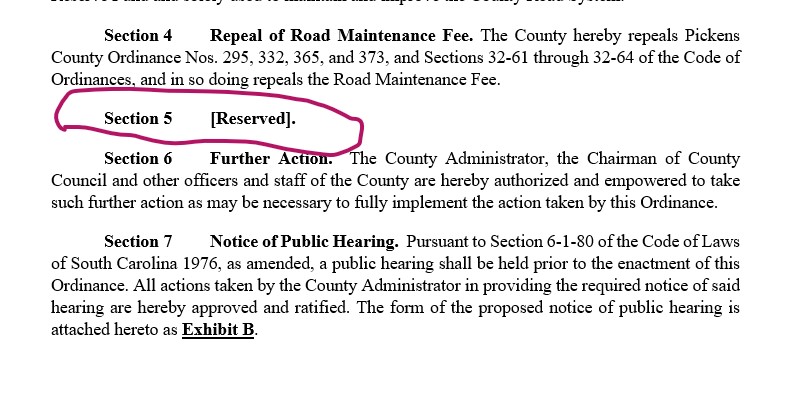

A renewal of the agreement passed the first and second reading. It was pulled from the final vote, but there is plenty of evidence to support my lingering concern it would be brought back up and passed later. For example, the chairman said, "If at some point we say, let's work with the municipalities, I think when that time comes we have that conversation." Costner said: “The IGA, we can talk about later. What it looks like, if it happens.” If you actually look at the ordinance they passed on second reading it has the city aggreement wording in there (see left below). On the third reading they took it out (see right below), but reserved the section for a potential future agreement to start giving money to cities for city owned roads again. Additionally, Whitehurst and I were the only two to publicly commit to not renewing the agreement.